How Coca-Cola Won the World Cup

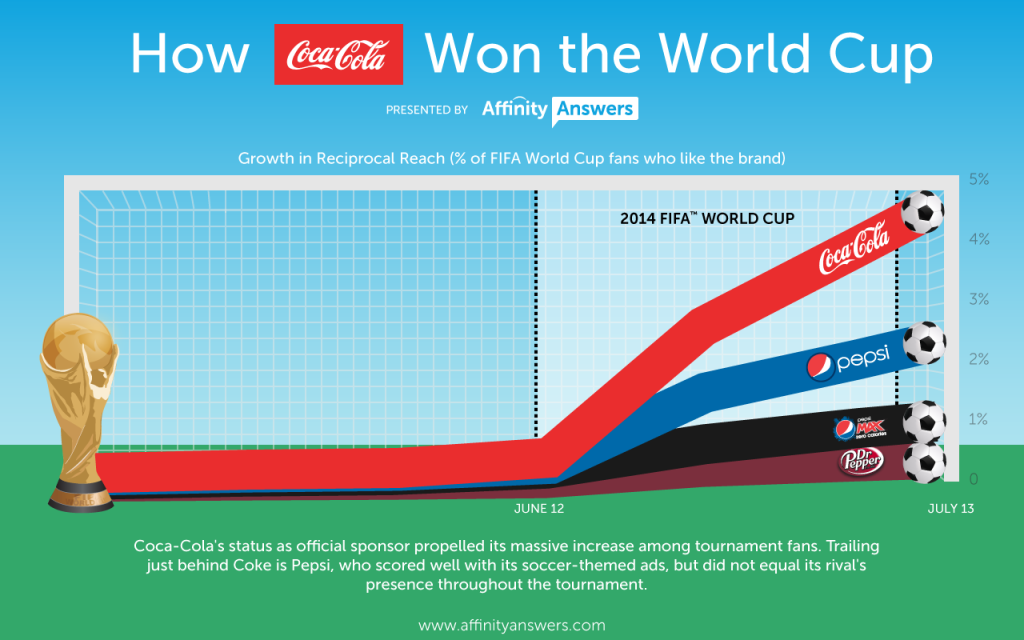

The World Cup festivities have ended, and Team Germany has taken its victory lap. But the war between soft drink titans Coke and Pepsi is never over. Which was the off-field victor in the 2014 World Cup? There are many different metrics that can define success for marketers. I’ll review some of them in a moment, but let’s first take a look at which soft drink brand won the title of greatest growth among fans of the tournament, according to Affinity Answers data:

Coca-Cola’s reach among tournament fans grew at twice the rate of its chief rival Pepsi. Affinity Answers data also shows that Coca-Cola was and is the #1 soft drink among tournament fans, continuing that momentum more than two weeks after the conclusion of the games.

Dissecting Coke’s Marketing Victory

So what was it that lifted Coke to marketing victory? It certainly ran content relevant ads that captured public attention, but so did Pepsi; its Lionel Messi ads trumped Coke’s “One World, One Game – Brasil” spots in ad awareness at a rate of 7% vs. 3%, respectively, according to noted consumer perception tracking firm YouGov BrandIndex. For Coke and the World Cup, 2014 was a year like no other. In fact, it was Coke’s largest-ever World Cup marketing campaign ever, which included:

- $600 million on Brazilian TV ads

- sponsorship of the trophy’s 92,000-mile journey through 90 nations

- 32 country-specific versions of this year’s anthem, “The World is Ours”

Arguably, brand awareness is more important than ad awareness, as it has the potential to translate to greater success. While short-term gains in advertising are certainly coveted, a brand can only claim success when its awareness grows and transforms into what is hopefully a long-term relationship with consumers. Coca-Cola emerged as the most recognized brand of the tournament – a finding revealed not by traditional survey methods, but by neuroscience conducted by Millward Brown, which “measures consumers’ intuitive feelings about a brand” and “[uses] the speed of reaction to questions as a test of the linkage between brand and event”. Both Millward Brown and Affinity Answers are progressive in their respective approaches. They record consumers passively, providing a deeper, more accurate portrayal of beliefs and intention. Affinity Answers makes this approach scalable by harvesting the brand engagement activities (e.g., posting, retweeting, etc.) of over 200 million Facebook and Twitter fans. Coca-Cola’s success following the World Cup on a brand level speaks volumes about consumers responding to an integrated marketing presence. Coke was everywhere it needed to be, impacting different pillars of the World Cup experience. This aligns with how fans experience the event – from an all-encompassing, 360-degree point-of-view. What’s In a Name? In the week preceding the 2014 World Cup, Coca-Cola already had a strong mutual affinity with FIFA World Cup, according to Affinity Answers’ proprietary algorithm. Having been the official sponsor since 1978, the strength between FIFA World Cup and Coke is much stronger than that of the bond between FIFA World Cup and Pepsi. However, the title of “official sponsor” or FIFA partner itself does not seem to pay off for all brands outside of the soft drink category. Many brands were leapfrogged by those who are not official sponsors:

- After the World Cup, Nike has higher mutual affinity than Adidas, despite the latter being the official partner

- Hyundai Global’s mutual affinity actually declined post-game vs. pre-game

- Castrol, Continental, J&J had weak mutual affinity vs. category competitors both before and after the World Cup

No one factor alone – social affinities, official partnership nor extensive marketing campaign – is a predictor of success or failure. However, Affinity Answers can help brands returning to an event or making their sponsorship debut decide which event is the best fit. Using Affinity Answers to Evaluate Success Post-Sponsorship It’s not uncommon for brands to see only a temporary bounce following a major campaign, including mutual affinity. How can you quantify how fans of your event feel about your brand after the pageantry is over? That’s where Affinity Answers can help: our database, refreshed on a weekly basis, can show you how your reach growth has been sustained. Reciprocal Reach Growth – Pre- and Post-2014 World Cup

| July 16 vs. June 11 (weeks ending) | July 30 vs. July 16 (weeks ending) |

| +884% | +8% |

| +700% | +2% |

As shown above, while both Coke and Pepsi had sizeable growth over the course of the World Cup, but Coke’s momentum continued after the tournament. This offers one more piece of evidence that Coke’s efforts paid off in the long run. While it is clear that there are significant headwinds to revive its carbonated beverage sales, the volume growth in second quarter can arguably be attributed to a sponsorship well-executed.

How could you put social affinity analysis to use when deciding your next sponsorship event or partner?